Submission Sent

We have received your submission and we'll get back to you shortly!

Oops! Something went wrong while submitting the form

Here's what homeowners are saying

Ian J.

Ben A.

Aundrick R.

Whether you are starting your ADU project soon or have plans for later, understanding how to pay for your ADU is a critical first step. ADU financing can be more complicated than a traditional mortgage but don't fret, you have plenty of options. The good news is that we’ve done the hard work to make it as easy as possible to get financing for your new ADU.

Our job is to be the best ADU resource in the world so we'll be updating this page regularly to give you the most recent figures so you can accurately plan for you ADU project. Interest rates rise and fall and when it comes to financing, outdated information is useless when trying to make a decision.

We’ll be covering 3 of the top financial products: Cash-out refis, HELOCs, and Home Share Investments. This is not investment advice but an educational resource to help you understand everything, without spending months of your own trying to get answers.

Home equity loans are built around the the amount of ownership you have in your home. You have home equity when your home’s value (check Zillow) is greater than the amount you owe.

There are multiple ways you can get home equity. First, when you buy a home, you pay a down payment. This initial down payment is the amount you have in home equity. Typically it's around 5-20%.

Another way to gain home equity is through home appreciation. Given that your home increases in value, which is called appreciation, you will own that amount as your home equity.

Home equity increases or decreases based on market demand. If you live in an area where supply is low but demand is high, you'll likely find your home equity increasing. Appreciation is like a savings account with untapped cash storing up automatically. You unlock that cash through a lender that will help you take out that value in exchange for debt. In exchange for taking that cash out, you take on more debt than you had before. In other words, you trade debt to get cash.

If you paid a 5% down payment, you have 5% in home equity.

If your home grows 20% in 5 years, you would have 25% in overall home equity (20% appreciation and 5% in down payment).

Cash-out refinancing is a way to leverage the home equity that you’ve built up and get cash for it. For example, if you bought your house for $400k and it’s now worth $600k, you have $200k of home equity. Out of that $200k, you can take out 80-90%, which is $160k - $180k.

You can use that cash for whatever you’d like. Homeowners love to use cash-out refis to pay off debt but many homeowners use the cash for remodeling a kitchen, bathroom, or adding a guest house.

Cash-out refinance is referred to as “refinance” because you change your mortgage and get a new one. Basically one lender buys out your existing lender (sometimes they are the same lender). The interest rate will most likely be different so take that into account. When you do a cash-out refinance, you have a lender providing a new mortgage with higher debt in exchange for cash that you can use for construction.

A home equity line of credit (HELOC) is a type of second mortgage, which you hold alongside your primary mortgage. It’s similar to a cash-out refinance where you can pull out a portion of the home equity that you have in the home and use the cash for any purpose. The major difference is that HELOCs are a second mortgage and they typically have variable interest rates. This means the rate would go up (or down) during the payback period of the loan.

The structure of a HELOC is like every credit instrument where there’s a “line” of capital that you can pull from. It’s designed so that you only pay interest on the capital you take out, until a certain date that is predetermined.

How HELOCs work is they let you borrow cash in "draws". This works well for construction projects because you will pay contractors when they hit certain milestones. The “draw periods” are typically 5-10 years and during those periods, you typically only pay interest. After 10 years, you pay the loan back with both interest and principal payments.

It’s important to note that most HELOCs have a variable interest rate which means the rate can go up or down depending on what the market is doing. This could leave people with monthly payments that are unfeasible. However, there are a growing number of lenders that offer fixed rate HELOCs so be sure to investigate both options.

Many homeowners can’t get qualified for home equity loans, or more importantly, they are able to add more debt to their monthly expenses. That’s where alternative financing shines. Instead of a monthly payment, you share in the future appreciation of your house.

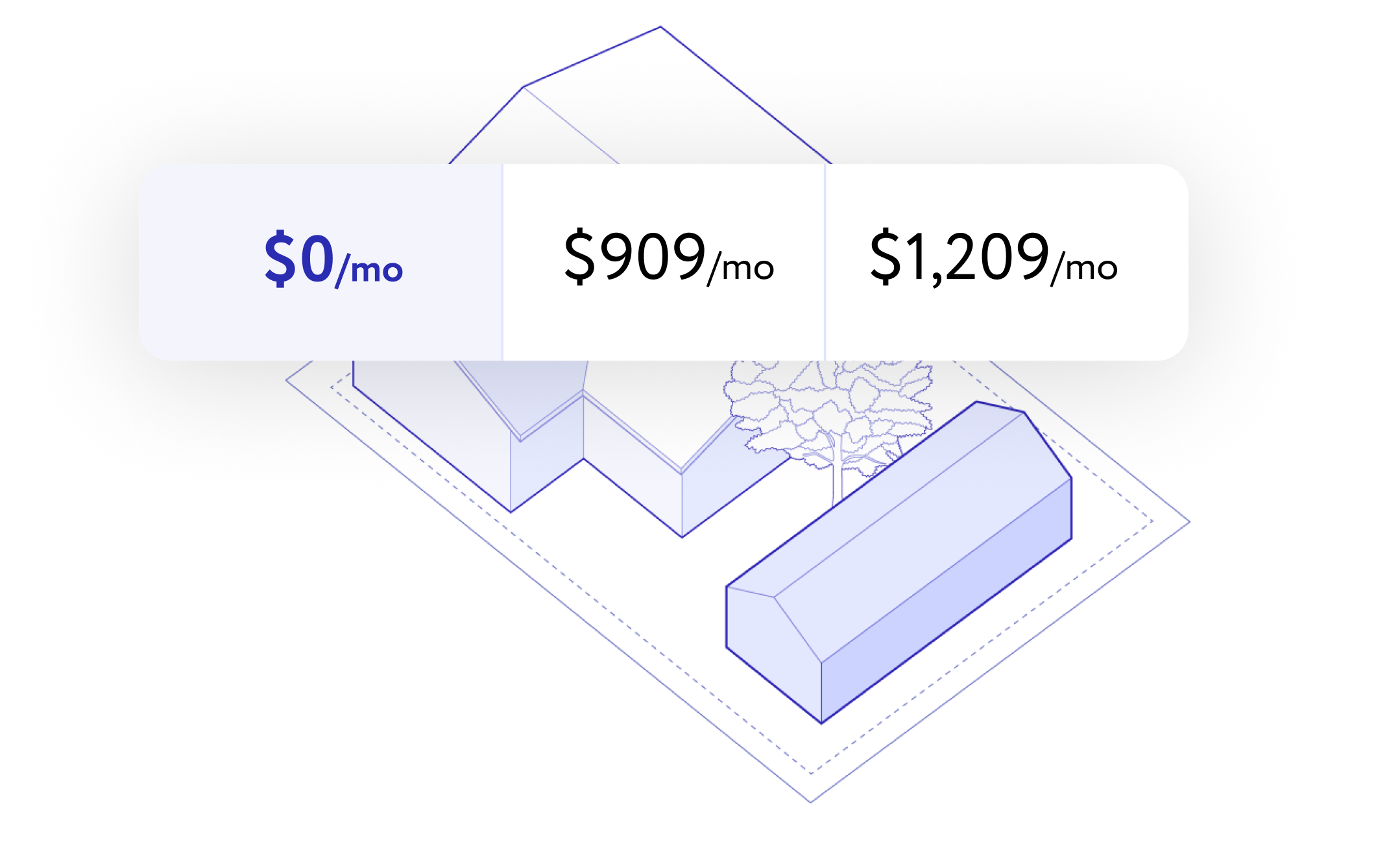

For homeowners that can’t get an ADU loan, there’s a new financing option called Home Share Investments (HSI). HSI is an investment, not a loan, where you receive the funds to cover an ADU without having to pay any monthly payments. In exchange, the investor gets a small share of the future appreciation of their home. Imagine having an ADU that generates $1k-$8k per month, without having to pay any monthly payments.

This investment is similar to a startup company getting an investment from a startup investor. In a startup, an investor offers capital to a team, in exchange for a share in their company. The investor is betting on the company growing.

Since these are investments on a speculation of your properties future value, they aren’t based on traditional requirements like credit score, debt-to-income ratios, and LTV. This means almost anyone can get qualified if you own a home.

Calculate and map out different scenarios with our ADU Equity Share calculator.

You might find that contractors or homebuilders are shy about giving you a price. They often will list their “base price” which doesn’t include site costs, permitting, scope buffers, and upgrades. Modular and prefab homebuilders have the ability to give you a more precise cost but they cannot give you shipping or site costs until a site analysis is completed. This analysis is step 1 for almost every homebuilder. You most likely will need some savings to cover this cost. Note that you will want some savings to also cover design. Homebuilders that have designs can include those in their prices. But if you want something custom that fits your backyard, you’ll want to hire a designer or architect.

If you live in California, you can take advantage of a new $40,000 CalHFA grant to homeowners building an ADU.

Before you get quotes from a lender for financing, start by getting an “all-in” estimate of how much your ADU will cost. This can be provided by your contractor or homebuilder and should include design, engineering, site work, labor, materials, permits, and more. Take that all-in number to multiple lenders and shop around for the best rates.

Alternatively, you could get a financing quote for the max amount. Then you could shop different homebuilders to fall within that budget.

A great place to start is with your local bank or credit union. They have incentive to support the local community and finance local projects. If they don’t have the right options, know that you always have other options. Financing is an incredibly large part of the economy with many lenders and brokers.

If you have any questions or if we can help at all, reach out and let us know how we can help!

---

Other resources: Learn more about Home Share Financing and Home Equity Financing. Use our Home Equity Investment Calculator to get an estimate for your ADU financing.